When the tax season is at its full-swing, here is bad news for you. While, you must be searching for ways to save income tax, but do you know, there are lucky folks in other regions who don’t need to pay any income tax? Yes, these regions exist on the Earth.

No one likes to pay tax to the government. Unfortunately, still, you have to pay tax if you are an Indian citizen. But there are various countries and territories in the world where you don’t need to pay tax.

Yes, you heard it right—there is no tax on salary.

Have a look at some of the places where you don’t need to pay tax:

Disclaimer: This post is not intended to hurt your feelings.

1) Bahamas

No tax is levied by Caribbean paradise on personal income, corporate profits and losses. The main source of government’s income is tourism and taxes like property tax, stamp duty tax and land value among others.

No tax is levied by Caribbean paradise on personal income, corporate profits and losses. The main source of government’s income is tourism and taxes like property tax, stamp duty tax and land value among others.

2) Bahrain

This oil-rich country doesn’t levy any income or corporate tax. However, like India’s Employee Provident Fund (EPF) scheme, both employers and employees have to contribute 9% and 6% of their basic salary towards social security contributions.

This oil-rich country doesn’t levy any income or corporate tax. However, like India’s Employee Provident Fund (EPF) scheme, both employers and employees have to contribute 9% and 6% of their basic salary towards social security contributions.

3) Brunei

Despite being a monarchy, the country is lenient when it comes to imposing a tax on individuals. However, this island country imposes taxes on corporate profits at the rate of 18.5%. In addition to this, there are direct taxes like vehicle tax, property tax, etc.

Despite being a monarchy, the country is lenient when it comes to imposing a tax on individuals. However, this island country imposes taxes on corporate profits at the rate of 18.5%. In addition to this, there are direct taxes like vehicle tax, property tax, etc.

4) Kuwait

As petroleum generates 90% of revenue for the country, it can afford not to impose tax on its citizens. There is neither any corporate tax, VAT or income tax on its citizens. However, foreign companies have to pay tax at the rate of 15% on it corporate income.

As petroleum generates 90% of revenue for the country, it can afford not to impose tax on its citizens. There is neither any corporate tax, VAT or income tax on its citizens. However, foreign companies have to pay tax at the rate of 15% on it corporate income.

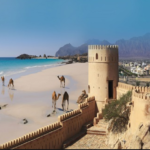

5) Oman

Another oil rich company, Oman doesn’t impose any tax on its individuals. However, there is a 15% corporate tax on business entities, except oil-based companies which have to pay tax at 15% rate. Then there is 3% tax on those companies whose registered capital is less than OMR 50,000.

Another oil rich company, Oman doesn’t impose any tax on its individuals. However, there is a 15% corporate tax on business entities, except oil-based companies which have to pay tax at 15% rate. Then there is 3% tax on those companies whose registered capital is less than OMR 50,000.

6) Qatar

The middle-eastern nation, Qatar levies zero tax on its citizens. There is a tax at the rate of 35% on those companies which operate in gas and petroleum sectors.

The middle-eastern nation, Qatar levies zero tax on its citizens. There is a tax at the rate of 35% on those companies which operate in gas and petroleum sectors.

7) Saudi Arabia

While salaried professionals do not need to pay income tax, there is 20% corporate tax on non-Saudis shares. Saudi shareholders only need to pay zakat (a religious tax) at 2.5% rate. If a company is exploiting natural gas and oil, there are taxes at the rate of 30% and 85% respectively.

While salaried professionals do not need to pay income tax, there is 20% corporate tax on non-Saudis shares. Saudi shareholders only need to pay zakat (a religious tax) at 2.5% rate. If a company is exploiting natural gas and oil, there are taxes at the rate of 30% and 85% respectively.

Image Sources: Arab News, CNN Money, Oman Air, Arabian Business, UK ASEAN Business Council, The New York Times, Gulf Insider, Sparefoot.

3,168 total views, 0 views today