5 Insurance and Investment Lessons from Bollywood

5 Insurance and Investment Lessons from Bollywood

Who says, Hindi movies are only about entertainment, entertainment, and entertainment! Today is the age of infotainment and believe me; one can learn a lot from Hindi films.Here is my list of films which give valuable financial gyaan. Read More.

What If Ekta Kapoor Enters Insurance Sector?

What If Ekta Kapoor Enters Insurance Sector?

After selling age controlling syrups and saas vashikaran capsules, Ekta Kapoor has forayed into insurance sector. Ekta Kapoor, Founder of ‘kkksurance’, said, “Our insurance company is different from others. Whenever a person applies for our policy, our agent goes to his address to spy on the family. Read More.

3 Smart Ways to Manage Unit-Linked Insurance Plans (ULIPs)

3 Smart Ways to Manage Unit-Linked Insurance Plans (ULIPs)

Unit-Linked Insurance Plans or ULIPs is a combination of life insurance cover and a market-linked investment plan. After deducting all charges and premium for risk cover, the insurer allocates a part of premium in different fund units. Read More.

Understanding Various Riders in Life Insurance – Which Ones Should You Opt For?

Understanding Various Riders in Life Insurance – Which Ones Should You Opt For?

Riders are add-ons that provide additional coverage over and above the basic life insurance plan. They offer benefits only on the occurrence of the specific eventuality for what they are bought for and do not replace the features of the policy. Read More.

To p 5 Reasons to Buy Term Insurance Policy Online

p 5 Reasons to Buy Term Insurance Policy Online

All you need is a good internet connection, and you can easily buy a term insurance policy either from the comfort of your home or while travelling. Apart from the ease, there are various other reasons also to purchase online term insurance. Read More.

7 Child Insurance Myths Debunked

7 Child Insurance Myths Debunked

Child insurance plans are insurance-cum-investment plans that financially protect your child’s future in your absence. On the death of a parent, the insurer pays the lump-sum amount to the child and waives all future premiums. Read More.

7 Factors Affecting Term Insurance Premium Rates

7 Factors Affecting Term Insurance Premium Rates

Life insurance premiums are based on various factors and it can be daunting for a prospective insurance buyer to understand them. Read More.

Beware: Employee Provident Fund Alone is Insufficient to Secure Your Retirement Life

Beware: Employee Provident Fund Alone is Insufficient to Secure Your Retirement Life

For most of the salaried professionals, retirement planning revolves around employee provident fund (EPF) only. Well, there is nothing wrong with the provident fund. In fact, the contribution is linked to the salary and increases with an increment. But by itself, PF is not sufficient for retirement. Read More.

7 Smart Ways to Use Your Annual Salary Bonus

7 Smart Ways to Use Your Annual Salary Bonus

Congratulations on getting the bonus. So, if you have some goals for yourself, you should use this amount to accomplish those goals. Here are seven useful tips which will help you make the most of the bonus amount. Read More.

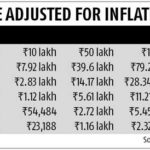

Will Rs 1 Crore Be Enough For Your Retirement?

Will Rs 1 Crore Be Enough For Your Retirement?

The amount of Rs 1 crore is the magical figure that is most often talked in India, particularly, since the launch of the iconic shows Kaun Banega Crorepati (KBC) in 2000-01. But will a corpus of Rs 1 crore see us comfortably through retirement after 20 or 30 years down the line? Read More.

These Expenses May Crop Up In the Year 2040

These Expenses May Crop Up In the Year 2040

Who says, you can’t predict future? With the proper analysis and thinking, you can predict the future events also. Just like, you can know about expenses which may arise in 2040. There may be some expenses which do not exist today but will make a hole in your pocket by 2040 or when you retire. Read More.

5 situations when you will not get tax benefits on insurance policies

People look for ways to save their income from the brunt of ‘income tax’ and thus, buy various insurance products. So, while, everyone knows that insurance can curtail their tax outgo, what are those situations when you will not get tax benefits even if you have bought the insurance products? Read More.

Understand Unit-Linked Insurance Plans (ULIPs)

Understand Unit-Linked Insurance Plans (ULIPs)

ULIPs stand for Unit-Linked Insurance Plans. It offers the dual benefits of insurance and investment. It gives the risk cover to the policyholder along with investment option to invest in a myriad of investment stocks like bonds, stocks or mutual funds. Read More.

Countries Where Citizens Don’t Need to Pay Income Tax

Countries Where Citizens Don’t Need to Pay Income Tax

When the tax season is at its full-swing, here is bad news for you. While, you must be searching for ways to save income tax, but do you know, there are lucky folks in other regions who don’t need to pay any income tax? Read More.

Life’s Best Lessons Taught By My Mother

Life’s Best Lessons Taught By My Mother

Do you know, all mothers have this amazing power of teaching without preaching? Mothers are the best teachers in the school of life. My mom has taught me so much about life which I can’t learn even in the world’s best college. Take a look at some of the lessons taught by my mother. Read More.

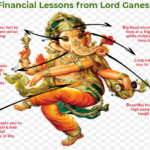

Lord Ganesha, Thank You For Financial Lessons!

Lord Ganesha, Thank You For Financial Lessons!

With Ganesha Chaturthi – the ten days festival of worshipping Lord Ganesha or Ganpati, the Indian festival season has started. But do you know, Lord Ganpati also teaches valuable financial lessons? On this Ganesh Chaturthi, let’s learn some financial tips. Read More.

3,249 total views, 0 views today