Did your pay cheque of this month become fatter? First, congratulations on getting the bonus. The vision of big LCD screens or that beautiful gold necklace that you saw last week in a jewellery shop, maybe swimming through your head. While you might be excited to spend that ‘extra’ money lavishly, it is a good idea to create a plan for this sum of money so that it doesn’t disappear much before you realise it.

As said by Warren Buffet, “If you buy things you do not need, soon you will have to sell things you need.”

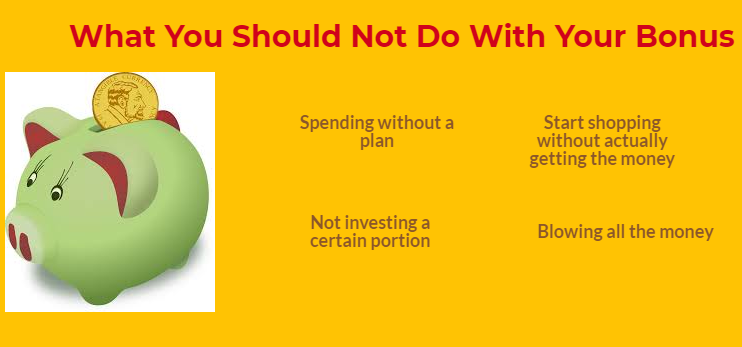

In the absence of a clear idea on how to judiciously use the money coupled with retailers wooing you with lucrative offers on everything, you may often end up spending your bonus on wasteful items.

So how can one use this amount to get benefits on the financial front? In behavioural finance, money is fungible and therefore, irrespective of its origins, all money should be considered as same. So, if you have some goals for yourself, you should use this amount to accomplish those goals. Here are seven useful tips which will help you make the most of the bonus amount.

- Indulge in splurging: It may not be what you were expecting to read in a financial article, but it is essential to reward yourself. Also, as per a well-documented behavioural phenomenon, known as ‘mental accounting,’ people treat money differently on the basis of their sources. For instance, people have a habit of spending more ‘found’ money, like tax refunds, windfall gains, bonus, and gifts, compared to their monthly salaries. To curb this urge, you can spend 10% of the bonus on yourself and your family. This will ensure that the remaining 90% will be there for investment.

- Repay a debt: Then work towards reducing your liabilities. Begin by repaying your costly debts, such as credit card, and a personal loan that you may have availed. You can also use salary bonus to repay a part of your education loan and car loan. Given the rising interest rates, your home loan may also become costlier in future. You can use the money to clear off a part of your home loan. Also, benefits will be more if you prepay your loan at an early stage of the loan when the outstanding principal amount is high.

- Spend money on skills enhancement: As far as job sector is concerned, in the last couple of years, many employees have laid off in sectors, like construction, real estate, and media. Keeping this thing in mind, one needs to do a lot more to upgrade their skills. Spend a portion of your bonus on books, training programmes and other such resources. Besides learning work skills, you should also learn life skills. Like, by saving a portion of your bonus, you can inculcate a habit of saving which would help you in the long run. Also, if you have a passion for dancing, singing or any other skill, you can use a portion of your bonus in cultivating your skills.

- Use funds to invest in tax-saving financial instruments: Instead of scrambling for tax saving instruments at the last minute, it is good to do tax planning in advance. You can use salary bonus to buy tax-saving financial instruments so that you will not have cash deficit at the end of the fiscal

- Buy term insurance: Life is unpredictable and therefore, it is essential to prepare yourself to deal with the uncertainty. This is the best time to buy a term insurance cover to ensure your family’s future financially even in your absence. Also, you can buy more cover in case you feel that the existing coverage is insufficient. Besides offering death benefits, there are various term insurance plans which offer coverage against critical illness and disability also. So use the bonus amount to insure yourself and family’s future.

- Invest in wealth plans: With your excess amount, you can buy a good wealth plan to grow your money in a long run. Since you have a large sum of money, a single premium wealth plan is a good option. As you pay your entire premium in one go, there is no chance of policy lapse due to non-payment. There are various single premium wealth plans which offer high returns by investing a portion of your money in equities and give double benefits of capital protection and life cover. Besides offering tax benefits, these plans protect your investment from market downturns through assured benefits.

- Set aside a contingency for rainy days: Emergencies always come unannounced, and therefore, having a contingency reserve in place for rainy days is essential. An adequate contingency fund gives you financial stability in case of unforeseen circumstances. Ideally, a corpus of about half a year’s salary is a good amount to keep as an emergency fund for some urgent financial requirements, such as job loss, critical ailment, and home repairing.

A right way to spend a bonus amount is to strike a perfect equilibrium between things which give immediate gratification and things which are good to strengthen your financial life in a long run. A bonus is the result of your hard work. By making its judicious use, you will not only fulfil your wishes but also be able to pat yourself on the back for making efficient use of it.

A right way to spend a bonus amount is to strike a perfect equilibrium between things which give immediate gratification and things which are good to strengthen your financial life in a long run. A bonus is the result of your hard work. By making its judicious use, you will not only fulfil your wishes but also be able to pat yourself on the back for making efficient use of it.

7,048 total views, 0 views today