Imagine your life 20 or 30 years down the line. Your children are well-settled in India or abroad. As a retiree, you are spending time with your grandchildren and doing activities for which you never found time during your professional life. You are having a great time, away from the hectic office schedule and tight work deadlines. Sounds great, isn’t it? To have such a ‘tomorrow’, you need to work ‘today’. As it is said, money can’t buy happiness, but it can buy things that make you happy. But how much should you save to retire peacefully?

The amount of Rs 1 crore is the magical figure that is most often talked in India. Particularly, since the launch of the iconic show Kaun Banega Crorepati (KBC) in 2000-01, becoming a Crorepati has become the dream of many people. Many investment plans in the market also promise to make you a crorepati by the time you retire. But will a corpus of Rs 1 crore see us comfortably through retirement after 20 or 30 years down the line? The answer is No.

Increasing medical cost

There is a frequent need for medical care during old age. If we look at the current cost of medical treatments in India, we would be able to guess how much you will feel the burden after retirement when your income will stop, but your expenses will continue to increase. According to the results of a cross-country survey on health conducted by the National Sample Survey Office, in the first half of 2014, there is a rise in hospitalisation costs.

Fall in value of rupee

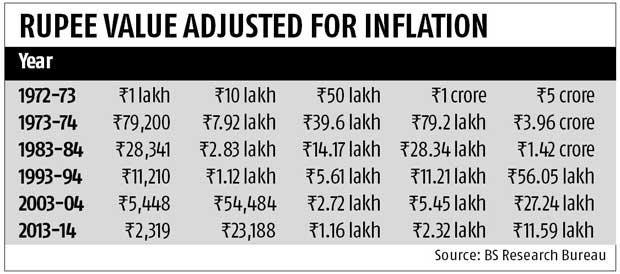

The Indian currency has been consistently losing its value in the past few years on account of the high inflation rate.

As evident in the following table, between 1984 and 1994, Rs 1 crore’s value fell to Rs 11.21 lakh.

In fact, the makers of KBC also increased the prize money to Rs 7 crore when Season 8 was aired in 2014 to beat the inflation.

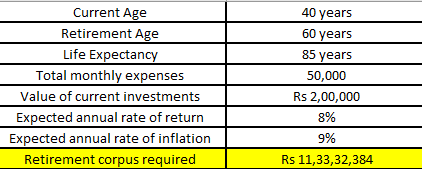

A case of retirement planning

Ravi, a 40-year old, works in an IT firm and earns Rs 1,20,000/month. He is planning to retire at the age of 60 years. He has to save enough to live a peace ful life until the age of 85, which is his life expectancy.

ful life until the age of 85, which is his life expectancy.

As per our calculation, Ravi needs to have around Rs 11 crores to survive until the age of 85 years. Hence, it is proved, Rs 1 crore is not sufficient. However, in some cases, a crore figure may be sufficient where one has other sources of income, such as rental income, among others. But in a broader sense, you will need more money to survive after retirement.

A Road-map to Build Retirement Corpus

Retirement planning needs thoughtful and careful approach. Now let’s understand how to plan for retirement.

- Measure the distance to target: Depending on the age, income and expenses, you can find out how long it would take you with your current investible surplus to reach the target. It will also help to clear three things:

- Whether your future expectations are realistic or not?

- Whether you should lower the target or not?

- Whether you should increase your disposable income to accomplish goals or not?

- Break it up: It is advised to break the main goals into intermediate goals and then attempts to achieve them. It will also help to review the progress and take corrective measures if required. Once you know the distance between your current state and target, you can look at different scenarios of savings required for achieving targets. Also, intermediate goals will help you to know whether you are on the right track or not. Also, it is important to set yearly targets for the rate of growth and then assess how much you need to save every month. Make sure to do a periodic review of the financial portfolio to ensure that it is in proper order.

- Save first, spend later: Instead of first calculating expenses and then investing the remaining funds, it would be good if you first set your saving target and then manage your expenses with the remaining disposable income. The wealth creation process depends on the income level and level of discipline. In the early age of life when there is no or less financial liability, one should look at managing expenses and focus on growing saving.

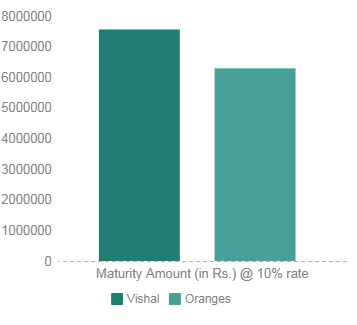

- The early bird catches the worm: It is always good to start early to enjoy the power of compounding. For instance, Vishal starts investing Rs 10,000/month at the age of 40 but his best friend, Rajesh starts saving Rs 15,000/month at the age of 45-year. At the time of retiring at 60, both will be having the following corpus:

Even when Rajesh is contributing more than Vishal, he will get the lesser amount on maturity. Therefore, the early you start, more you will be able to save.

Even when Rajesh is contributing more than Vishal, he will get the lesser amount on maturity. Therefore, the early you start, more you will be able to save.

- Choose right investment options: Here are the three best investment options for retirement:

- Public Provident Fund (PPF): It is an attractive investment option offering 1% interest, along with tax benefits. You can open a PPF account with an initial investment of Rs 500.

- New Pension Scheme: Here you can choose to invest your money in three different fund options: equity, corporate bond, and government bond. An individual’s saving is invested by Pension Fund Regulatory and Development Authority in diversified portfolios, including government bonds, debentures, and shares.

- ULIP retirement plans: ULIP retirement plans score over other debt plans as the policyholder can enjoy benefits from equity exposure and protect its investment from market volatility. Over the long term, ULIPs have the potential to generate better results. Further, ULIP plans, such as ICICI Pru Easy Retirement, offer assured benefits to protect your savings from market fluctuations. You can also increase your retirement corpus through pension boosters. Moreover, you can buy these plans online also with a click of the mouse.

And in the end, it’s not the years in your life that count, it’s the life in your years— Abraham Lincoln

Retirement means the end of working for someone else and the beginning of living for yourself and your dreams. While after retirement, you have time to do what you always wanted to do, but make sure you have enough money to make things happen. Also, early investment will reduce the heartburn that you may get at the end of your working life when the time is not on your side. After working for so many years, you owe a peaceful retirement life to yourself and therefore, make the rest of your life, the best of your life with the proper planning. Waiting doesn’t help, does it?

3,359 total views, 0 views today